Short-Term Rental (STR) Loans For…

Finance a Second Home

Welcome to second home occupancy, where rest and relaxation meet income generation. As Team Parker has second home occupancies in our own portfolios, we know what it takes – and how – to secure them. Leverage our expertise to expand your real estate portfolio today.

Team up with our Wealth Builders Mortgage Group, even if other lenders have turned you down. We specialize in securing solutions that others can't because we believe building and diversifying a short-term rental portfolio should be accessible to everyone. Let's start building and diversifying yours.

STR Financing for All

Second home occupancy. Short-term rental loan. Vacation home financing. No matter what you call it, Team Parker will help you secure it.

We believe in financial freedom through investing and work with a range of STR investors to help them build generational wealth. Team Parker takes a deep dive into every situation; that's just one of the many reasons we can close on loans that others can't. Schedule a time to chat with our investing masters and start building wealth with help from an STR loan.

A Fast Path to Funding

In real estate investment, things move quickly. If you don't quickly act on a property, you may lose the chance altogether. As investors with portfolios of 10+ short-term rentals, we understand that time is of the essence. Because we're a group under Movement Mortgage, a national lender, Team Parker:

- Creates our own smooth processes with speedy timelines

- Completes underwriting ourselves

- Funds loans right at closing

Getting you another step closer to financial freedom. We're one of the top STR originating teams in the nation for a reason, and we're here to help you take advantage of every second home occupancy opportunity that comes your way.

Why Your Portfolio Needs STRs

Passive Income

Short-term rental properties don’t typically require the oversight that other types of investments demand, making it an easy way to generate passive income.

Diversification

A diverse portfolio is one of the best ways to build long-term wealth and protect yourself from unexpected downturns in other markets.

Tax Incentives

If the home is rented out for the majority of the year, you may qualify for an impressive number of tax breaks, like property tax deductions.

Let’s Chat Eligibility

STR loan eligibility is yet another way we stand apart from other lenders. We don’t list specific requirements because we understand that every buyer and opportunity is different. We are not a one-size-fits-all mortgage lender.

We’ll work with you as the individual you are and get you qualified as-is or set you up for future success. It all starts with a phone call.

Short-Term Rental Loan FAQs

While these are our frequently asked questions, not every answer applies to every buyer. Answers largely depend on your specific situation, and we invite you to schedule a consultation with us to ask these questions or any others you may have.

The Team Parker Process

- Pre-approval consultation – We’ll discuss your situation, map out the future purchases you’re considering, and review your debt-to-income ratio and cash-to-close reserves.

- Pre-approval letter – Once approved, we’ll issue your pre-approval letter. Think of this as your ticket to shop the market, as it shows you’re a serious buyer.

- Explore STR options – This is when you’ll hit the market, exploring your second home occupancy options. Check in with us if any questions arise as you search!

- Lock in – You’ve found a place and made an offer that’s been accepted. Now that you’re under contract, we’ll set up your loan and lock in your rates.

- Reap the rewards – All that’s left to do is enjoy the income generated from your STR!

From pre-approval clear to close, we’re here for you.

In Their Own Words

What’s it like working with someone who will always go to bat for you, someone who has closed over $900M in transactions? Hear directly from those who have partnered with Team Parker to scale their real estate portfolio.

1/17

1/17

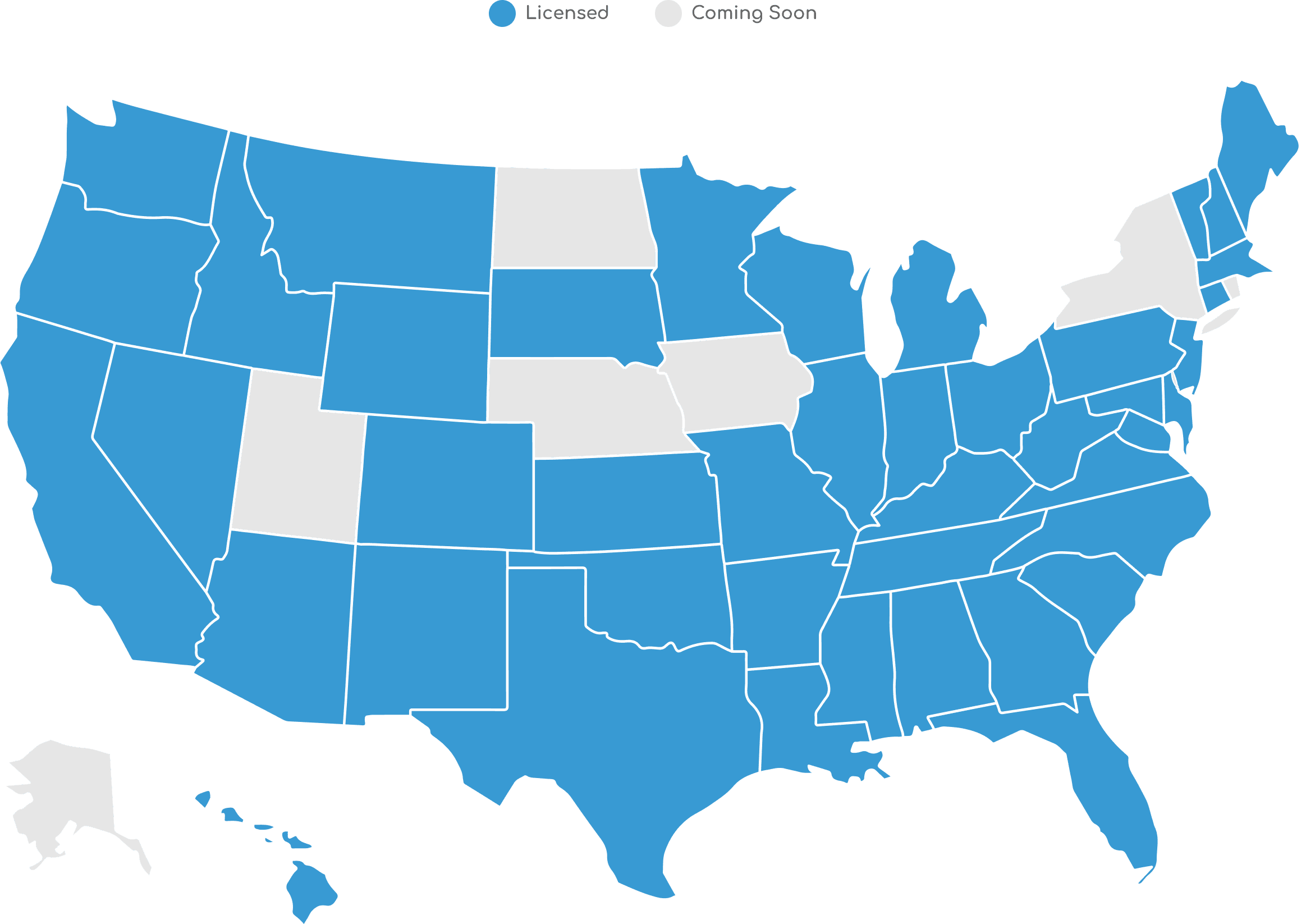

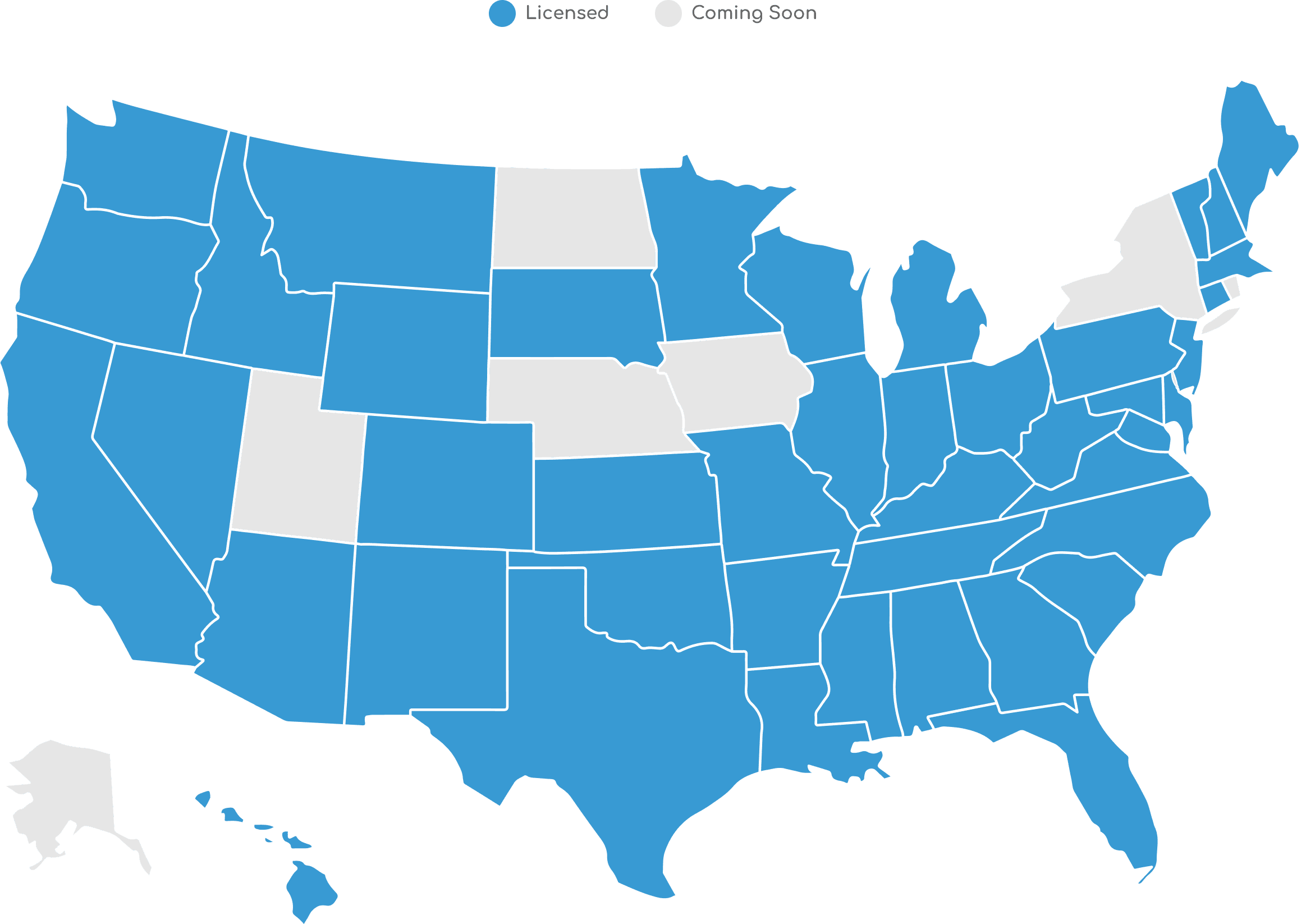

Coast-to-Coast Loan Coverage

We partner with investors and homebuyers all across the country. While based in Tennessee, Wealth Builders Mortgage Group is licensed in 44 states, and because we never give less than 100%, we’re going for all 50.

More Loans to Explore

Not sure if a short-term rental loan suits your situation? We offer a number of other financing options to explore because it’s your wealth; build it your way.

Knowledge Is Power

Build Wealth Through Real Estate

You deserve more than a loan officer – you deserve an experienced fellow investor and a dedicated support team ready to share their expertise with you. Start or diversify your portfolio by partnering with Wealth Builders Mortgage Group today.