Conventional Loans For…

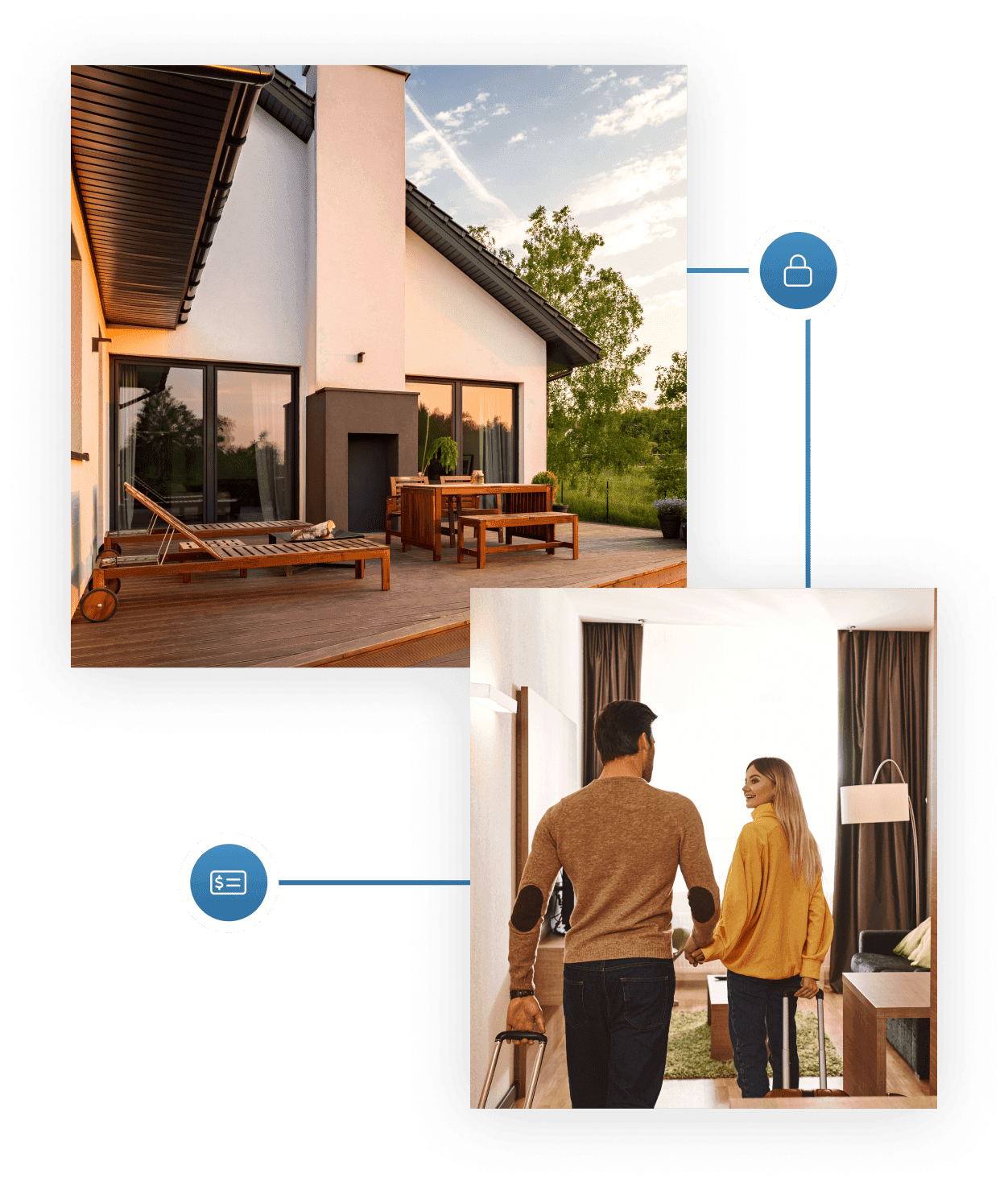

Secure a Second Home With 10% Down

As part of Movement Mortgage, a national lender, Team Parker can help you kick off your real estate portfolio with a second home. Our conventional loans feature in-house underwriting and funding right at closing. No holdups here – just streamlined processes, guidance from investors turned lenders, and options with down payments as low as 10%.

Start generating wealth and building financial freedom by applying for a conventional loan for second home occupancy now.

Specializing in Unconventional Conventional

Entrepreneurs with complex tax returns, multiple businesses, max write-offs on tax returns, let us take a shot! Low credit score? There may still be options for you! Armed with the knowledge, skill, and desire that not all others possess, we have had much success in finding conventional loan options that other lenders have not. If we can’t help you now, we can provide the information or resources to help you get there as soon as possible.

A Fast Path to Funding

In real estate investment, things move quickly. If you don't quickly act on a property, you may lose the chance altogether. As homebuyers and investors with portfolios of 10+ short-term rentals, we understand that time is of the essence. Because we're a group under Movement Mortgage, a national lender, Team Parker:

- Creates our own smooth processes with speedy timelines

- Completes underwriting ourselves

- Funds loans right at closing

Getting you another step closer to financial freedom. We're one of the top originating teams in the nation for a reason, and we're here to help you take advantage of every investment, second home occupancy, and primary home opportunity that comes your way.

The Draw of Conventional Loans

Low Down Payments

Conventional loans offer some of the lowest down payments available, from just 3% on a primary home to only 15% on investment occupancy.

Variety

Conventional loans are one of the few that can be used for a variety of purchase types, from a first home purchase to a multi-unit dwelling.

Flexible Terms

Great credit? Low interest rates. Looking to save money? Shorter terms. This loan product offers the flexibility that many buyers are looking for.

Who’s Eligible?

Because loans are not a one-size-fits-all product, we encourage you to reach out to Team Parker to discuss your unique situation. Instead of asking Google and falling down a seemingly endless rabbit hole, we’ll give you the specific, actionable information you’re looking for. Get set up for conventional loan success by chatting with our investment experts today.

Conventional Loan FAQs

The Team Parker Process

- Pre-approval consultation – We’ll discuss your goals, review your debt-to-income ratio, and learn about your cash-to-close reserves before examining your loan options.

- Pre-approval letter – Once approved, we’ll issue your pre-approval letter. Think of this as your ticket to shop the market, as it shows you’re a serious buyer.

- Explore purchase options – This is when you’ll hit the market, exploring available properties. Check in with us if any questions arise as you search!

- Lock in – You’ve found a place and made an offer that’s been accepted. Now that you’re under contract, we’ll set up your loan and lock in your rates.

- Reap the rewards – All that’s left to do is enjoy the property and any generated investment occupancy income!

From pre-approval clear to close, we’re here for you.

In Their Own Words

What’s it like working with someone who will always go to bat for you, someone who has closed over $900M in transactions? Hear directly from those who have partnered with Team Parker to scale their real estate portfolio.

1/17

1/17

Coast-to-Coast Loan Coverage

We partner with investors and homebuyers all across the country. While based in Tennessee, Wealth Builders Mortgage Group is licensed in 43 states, and because we never give less than 100%, we’re going for all 50.

More Loans to Explore

Not sure if a conventional loan fits your goals? Team Parker offers several other financing options to explore because it’s your wealth; build it your way.

Knowledge Is Power

Build Wealth Through Real Estate

You deserve more than a loan officer – you deserve an experienced fellow investor and a dedicated support team ready to share their expertise with you. Start or diversify your portfolio by partnering with Wealth Builders Mortgage Group today.