Refinance Loans For…

Re-evaluate for Better Terms

Lower monthly payments, save on interest, pay off your second home occupancy mortgage faster – there are so many perks to refinancing, and Team Parker will ensure the benefits outweigh associated refi costs.

From DSCR and jumbo loans to conventional and FHA, we’re experienced in refinancing a variety of lending products and look forward to learning how we can help you achieve financial freedom that much faster.

Explore Money-Saving Options

A loan that worked for you at one time may not be the loan that works for you now. Your financial situation and needs are ever-evolving. No one understands that better than Team Parker, as we’re not only experienced lenders but investors with refinanced properties.

And we’ll give it to you straight. We’re not here to sell you on an investment home occupancy refi. Instead, we’re here to help you build your wealth and will make recommendations that align with that goal. Start an application to get your information into our experienced hands today.

Determine if a Home Loan Refinance Is Right for You

Wondering if the home loan you secured is still the best one for where you’re at now? Let Team Parker review the numbers, opportunities, and potential refinance options that are available in today’s market.

Our lending experts can assist no matter your financial situation or the type of loan you currently have – conventional to VA or FHA; we’ve refi’d it all and can help ensure you’re set up with the situation that benefits you now and long-term.

Refi Your Way

Rate, term, cash-out; you name it, we have refinancing solutions for it! As mortgage refinancing is very situational, you need an experienced team handling your transaction, like Team Parker. We’ve closed numerous refi loans, including DSCR, jumbo, VA, and FHA, and will bring our expertise to your situation. Explore your options today!

A Fast Path to Funding

In real estate investment, things move quickly. If you don’t quickly act on a property, you may lose the chance altogether. As homebuyers and investors with portfolios of 10+ short-term rentals, we understand that time is of the essence. Because we’re a group under Movement Mortgage, a national lender, Team Parker:

- Creates our own smooth processes with speedy timelines

- Completes underwriting ourselves

- Funds loans right at closing

Getting you another step closer to financial freedom. We’re one of the top originating teams in the nation for a reason, and we’re here to help you take advantage of every mortgage refinancing opportunity that comes your way.

Benefits for Every Situation

Reduce Borrowing Costs

A mortgage refinance may help you secure a more competitive interest rate than you currently have. That’ll help you save money in the long run.

Extend Terms

Lengthening your payback period may be possible with a loan refinance, which reduces your monthly financial burden.

Pay Off Mortgage Faster

If your financial situation has changed for the better, shortening your loan term may be worth considering, as you’ll pay off your mortgage faster.

Eligibility Isn’t a Straightforward Answer

Just because you may qualify for a loan refinance doesn’t necessarily mean you should refinance. Ensure you’re making smart moves that benefit and protect your financial health – schedule a complimentary consultation with Team Parker to determine if refinancing is right for you.

Refinancing FAQs

At what point is refinancing beneficial?

Because refinancing is very situational, the answer is: It depends! Typically, the larger the loan, the less the rate needs to change for the borrower to benefit from refinancing.

If you’re wondering if now is the time to explore your refi options, schedule a consultation with our experts. Team Parker will review the numbers and give you our expert advice. If it doesn’t benefit you, we’ll be the first to say so.

What does the refinancing process look like?

It’s quite similar to the original loan process but with fewer steps!

– once we have a better understanding of what you’re looking to accomplish through refinancing, we can better outline the steps involved.

Are refi rates better than purchase rates?

It all depends on the situation. Generally speaking, refinance rates are similar to purchase rates. Chat with our experts about your needs – we’ll explore options and rates that get you one step closer to financial freedom.

When can I do a cash-out refinance?

For rate or term, you should be able to do a cash-out refinance at any time unless there’s something unique about your situation.

A cash-out refi that meets the delayed financing exception can also be done at any time. If you don’t meet the delayed financing exception, the typical timeframe is 6 or 12 months, depending on the loan type and how the property was purchased. Contact us to discuss your specific cash-out refinance options!

Are appraisals required for refinances?

Not always! Let Team Parker guide you through your options, ensuring you’re making moves that protect and enhance your wealth.

The Team Parker Process

- Consultation – We’ll discuss your situation, learn about what you’re looking to accomplish through refinancing, and explore your options.

- Application – Once we’ve found the right refi for you, you’ll officially apply.

- Appraisal (if necessary) & underwriting – We’ll work together to get an appraisal scheduled if needed, and from there, we’ll get to underwriting. Since we do this in-house, it’s often a quick process.

- Reap the rewards – All that’s left to do is enjoy the benefits of your refi!

From pre-approval clear to close, we’re here for you.

In Their Own Words

What’s it like working with someone who will always go to bat for you, someone who has closed over $900M in transactions? Hear directly from those who have partnered with Team Parker to scale their real estate portfolio.

Brad

Super helpful! Parker is super responsive and is more advisor than lender for our business. She’s does the short term rental business herself, so can relate first hand to what we do. She has a wide variety of loan products available, so it’s easy for her to find something that works. Her rates are competitive with other lenders (even direct to the bank). Highly recommended.

Avery C

I'll never use anyone else! Parker was recommended to me by a real estate agent friend for an investment property I was working on purchasing back in December of 2016. Since then I have used her for every real estate purchase I have made and never looked back, and I also refer all of my clients and friends to her. She is incredibly knowledgeable, and quick in getting things done, and you never have to call her twice to get a question answered. I highly recommend Parker to both new and seasoned homebuyers. She makes the process smooth and easy!

Michelle

Parker is fantastic. 2nd time working with her and it won't be the last Parker worked with us on 2 short term rentals in the Smokies. Both experiences went very smoothly and easily closed within 30 days. Parker owns short term rentals herself so she is an expert with these types of loans. I couldn't have bought the 2nd rental if I wasn't working with Parker. A++ Loan officer!

Crystal

Above and Beyond Customer Service Parker helped us through the process from beginning to end. She even made it to our closing. She provided guidance through the approval process and suggested ways to increase my credit score in ways to allow me to be approved faster than i had expected. She gave us realistic expectations even when i had been told my other lenders that it was possible. There was no question that was too small and she was available at a drop of a dime to answer our calls or call back almost immediately. She was an absolute pleasure to work with and would most definitely and will most definitely work with her in the future. We have already recommended her to so many of our friends!

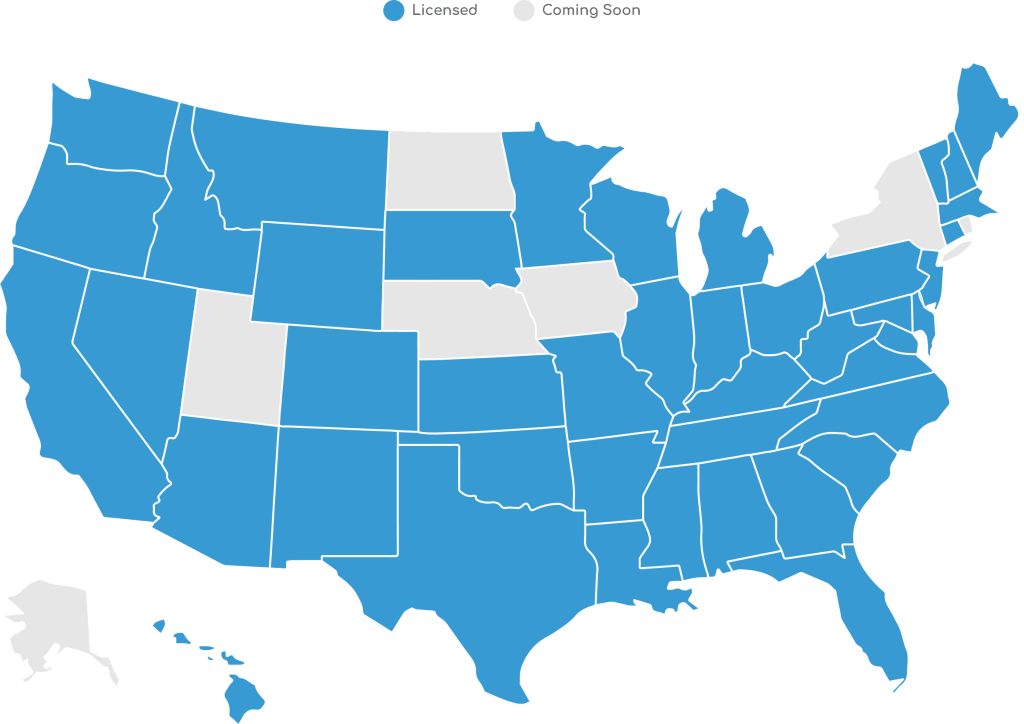

Coast-to-Coast Loan Coverage

We partner with investors and homebuyers all across the country. While based in Tennessee, Wealth Builders Mortgage Group is licensed in 44 states, and because we never give less than 100%, we’re going for all 50.

More Loans to Explore

Not sure if refinancing fits your goals? Team Parker offers several other financing options to explore because it’s your wealth; build it your way.