Debt Service Coverage Ratio (DSCR) Loans For…

Snag a Second (Investment) Home

Generate income with help from a DSCR mortgage loan. They’re great options for those looking to invest in a property that won’t be used as a primary residence. A debt service coverage ratio loan can only be used to purchase a rental property for business purposes, making it a great portfolio diversification tool. DSCR loans can be tricky to navigate, so let Team Parker be your guide. We’ll take you from pre-approval clear to close.

Invest With Help From a DSCR Loan

We’re investors helping investors. Team Parker knows just what you’re looking for with a DSCR loan, as we’ve been through the process ourselves. Use our expertise and guidance to evaluate all your debt service coverage ratio loan options – if we think there are better loan products for your situation, we’ll go over those, too. Turn to Wealth Builders Mortgage when you’re ready to be set up for both immediate and long-term success.

What Is a DSCR Loan?

A debt service coverage ratio loan is a mortgage loan for a residential property that will produce income – you’re buying the property intending to rent it out. DSCR loans are great options for both experienced and novice real estate investors because they don’t rely on personal finances. Approval is based on the potential generated income of the property. Interested in learning more? Let’s chat.

Team Parker Perks

- No prepayment penalties

- Only 20% down on 2-4 unit properties

- An allowable ratio of 1.01

- Rate, term, or cash-out refinance options

Our DSCR loan program comes with perks! Wealth Builders Mortgage Group operates under Movement Mortgage, so we have total loan control.

No lengthy, confusing processes here – just straightforward debt service coverage ratio loans that we fund at closing, helping you easily tap into another source of wealth-building income.

Look Forward To

Less Documentation

Invest with less paperwork. As DSCRs are not dependent on personal income, fewer documents need to be reviewed – which also means shorter closing timelines.

Multiple Properties

Because financing is based on the property itself, not a buyer’s finances, it’s possible to buy multiple properties at once. Build wealth that much faster!

More Options

Go beyond single-family and 2-4 unit properties – these loans often cover mixed-use properties and larger apartment buildings, giving you more diverse options.

DSCR Loan Requirements

A DSCR loan is as unique as the person applying – no one understands that better than Team Parker, as we’re highly experienced in this specialty loan product. Because funding is determined on a case-by-case basis, we encourage you to schedule a consultation.

We’ll review everything you need to know about these loans, go over your specific situation and potential investment opportunities, and help you find the best way forward.

A Fast Path to Funding

- Consultation – As these are specialty loan products, the first and most crucial step is discussing your opportunity with Team Parker. From there, we’ll get you pre-approved or develop an actionable plan to help you get there.

- Approval – Once approved, we’ll issue you a pre-approval letter. Now you can hit the market and browse for your perfect property.

- Funding – You’ve found your place and are under contract. It’s time to lock in your rates, complete paperwork, and get you funded.

Our streamlined approach takes you from consultation through to closing in a matter of weeks. Many clients come back for DSCR funding time and time again, and you can, too!

In Their Own Words

What’s it like working with someone who will always go to bat for you, someone who has closed over $900M in transactions? Hear directly from those who have partnered with Team Parker to scale their real estate portfolio.

Crystal

Above and Beyond Customer Service Parker helped us through the process from beginning to end. She even made it to our closing. She provided guidance through the approval process and suggested ways to increase my credit score in ways to allow me to be approved faster than i had expected. She gave us realistic expectations even when i had been told my other lenders that it was possible. There was no question that was too small and she was available at a drop of a dime to answer our calls or call back almost immediately. She was an absolute pleasure to work with and would most definitely and will most definitely work with her in the future. We have already recommended her to so many of our friends!

Antonio B

The Best! Parker was specifically recommended to us as being knowledgeable about financing for short-term rental property. We just closed on our second property, with her assistance. There were a number of twists and turns along the way, but Parker was always pleasant, professional, gave good advice, and we always felt that she had our back. She was easy to reach when needed. Because we were looking at property in 4 different states in our region, it helped that she was licensed in all of those states. You know how, when people are good at their job, they make it seem effortless? That is Parker. Just reach out to her, you will be glad you did.

Avery C

I'll never use anyone else! Parker was recommended to me by a real estate agent friend for an investment property I was working on purchasing back in December of 2016. Since then I have used her for every real estate purchase I have made and never looked back, and I also refer all of my clients and friends to her. She is incredibly knowledgeable, and quick in getting things done, and you never have to call her twice to get a question answered. I highly recommend Parker to both new and seasoned homebuyers. She makes the process smooth and easy!

Lenny B

Great loan officer/very easy process Parker was a great delight to work with. She walked my wife and myself easily through the process of financing our first home. She worked very hard to get us the best interest rates and the best type of loan for our situation. She was very reachable also for any questions we might have had. We highly recommend her!

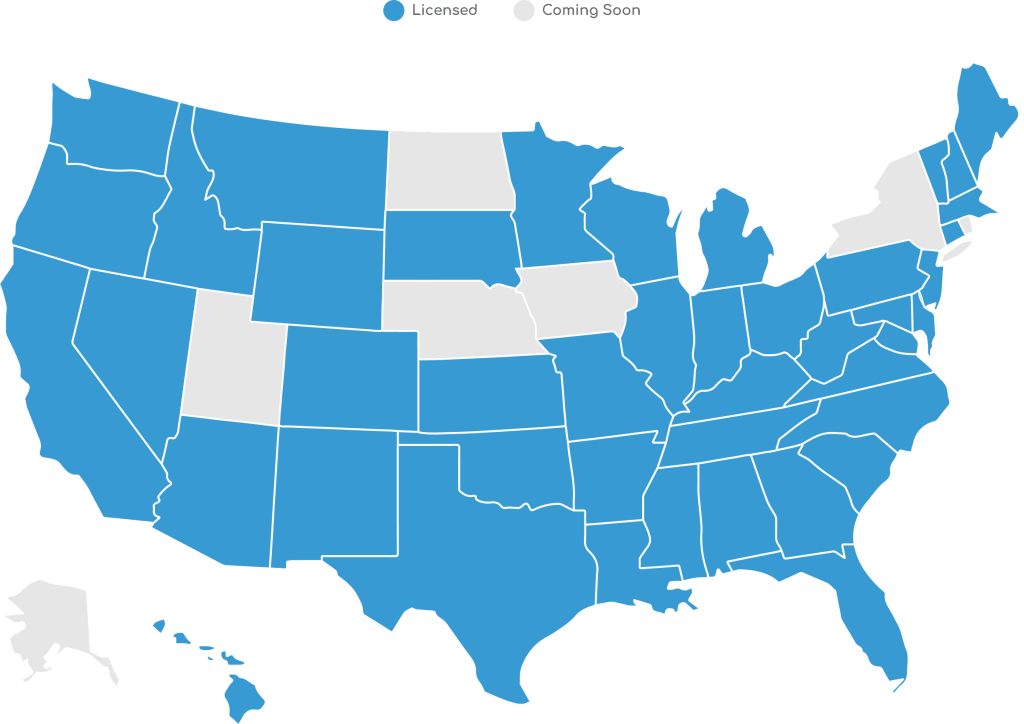

Coast-to-Coast Loan Coverage

We partner with investors and homebuyers all across the country. While based in Tennessee, Wealth Builders Mortgage Group is licensed in 44 states, and because we never give less than 100%, we’re going for all 50.

More Loans to Explore

Not sure if a DSCR loan suits your goals? Team Parker offers several other financing options to explore because it’s your wealth; build it your way.