Conventional Loans For…

Secure a Second Home With 10% Down

As part of Movement Mortgage, a national lender, Team Parker can help you kick off your real estate portfolio with a second home. Our conventional loans feature in-house underwriting and funding right at closing. No holdups here – just streamlined processes, guidance from investors turned lenders, and options with down payments as low as 10%.

Start generating wealth and building financial freedom by applying for a conventional loan for second home occupancy now.

Investment Occupancy Loans, Just 15% Down

The beauty of conventional loans? They work for a variety of investors and situations. The beauty of securing one for investment occupancy with help from Wealth Builders Mortgage Group? Just 15% down payment and zero third-party dependence or holdups.

Our group of investors turned lenders is backed by Movement Mortgage, a national lender. Because of that, Team Parker offers in-house underwriting and funds conventional loans right at closing. Grow your real estate portfolio fast with help from seasoned investors and experienced lenders.

Buy Your First Home With as Little as 3% Down – Or Even 0!

If you’re ready to explore conventional home loans to buy your first house, first things first: congratulations! Team Parker has been in your shoes, and we know how overwhelming the entire process can be.

Rest assured, Wealth Builders Mortgage Group will guide you every step of the way, providing as much information as you’d like. Let’s start building your real estate portfolio by getting you on the road to homeownership!

Specializing in Unconventional Conventional

Entrepreneurs with complex tax returns, multiple businesses, max write-offs on tax returns, let us take a shot! Low credit score? There may still be options for you! Armed with the knowledge, skill, and desire that not all others possess, we have had much success in finding conventional loan options that other lenders have not. If we can’t help you now, we can provide the information or resources to help you get there as soon as possible.

A Fast Path to Funding

In real estate investment, things move quickly. If you don’t quickly act on a property, you may lose the chance altogether. As homebuyers and investors with portfolios of 10+ short-term rentals, we understand that time is of the essence. Because we’re a group under Movement Mortgage, a national lender, Team Parker:

- Creates our own smooth processes with speedy timelines

- Completes underwriting ourselves

- Funds loans right at closing

Getting you another step closer to financial freedom. We’re one of the top originating teams in the nation for a reason, and we’re here to help you take advantage of every investment, second home occupancy, and primary home opportunity that comes your way.

The Draw of Conventional Loans

Low Down Payments

Conventional loans offer some of the lowest down payments available, from just 3% on a primary home to only 15% on investment occupancy.

Variety

Conventional loans are one of the few that can be used for a variety of purchase types, from a first home purchase to a multi-unit dwelling.

Flexible Terms

Great credit? Low interest rates. Looking to save money? Shorter terms. This loan product offers the flexibility that many buyers are looking for.

Who’s Eligible?

Because loans are not a one-size-fits-all product, we encourage you to reach out to Team Parker to discuss your unique situation. Instead of asking Google and falling down a seemingly endless rabbit hole, we’ll give you the specific, actionable information you’re looking for. Get set up for conventional loan success by chatting with our investment experts today.

Conventional Loan FAQs

Do I have to put 20% down to secure a conventional loan?

No! The minimum guideline requirement for a primary home is 3% with qualifying circumstances. 5% is a standard allowable downpayment.

For second home purchases, the minimum down payment amount is 10%, and 15% for investment occupancy single-family homes.

Is an investment occupancy loan the same as a commercial one?

It is not! An investment or conforming investment occupancy loan is a Fannie Mae/Freddie Mac-backed loan.

Think of commercial loans as business ones. For example, if you wanted to invest in real estate by buying a restaurant, you’d need a commercial loan, not an investment occupancy one.

Do I have to have two years of short-term rental income on my tax returns before it can be counted?

No, not for conforming loans. In fact, we can even use this income with less than one year of reporting as long as the tax return has been filed.

Do I have to have two years of self-employment on my taxes in order for it to count?

Not always – in many cases, we can use one year of your self-employment income. Contact Team Parker to learn more.

If I just started a new W2 job, can the income be counted?

Absolutely. Any regular income that is not variable from your new job can be counted.

I just graduated college and started working. Do I have to wait two years before my income can be counted?

Nope, we can typically count full-time hourly and salary income immediately. Some stipulations may apply, but we’ll review those with you as we discuss your options.

Will bonus depreciation/cost segregation expenses hurt my rental income on my tax returns?

No – we can add all of that back into the income equation. Have at it!

How long does it take to close on a property?

30 days is comfortable and ensures a smooth, enjoyable process. We can close in less than 30 days if necessary – we’ve even closed in one week for clients who had financing through another lender fall through. Just note, though, that a quick turnaround can be more stressful because you’ll need to complete all paperwork in less time.

The Team Parker Process

- Pre-approval consultation – We’ll discuss your goals, review your debt-to-income ratio, and learn about your cash-to-close reserves before examining your multi-unit loan options.

- Pre-approval letter – Once approved, we’ll issue your pre-approval letter. Think of this as your ticket to shop the market, as it shows you’re a serious buyer.

- Explore purchase options – This is when you’ll hit the market, exploring available properties. Check in with us if any questions arise as you search!

- Lock in – You’ve found a place and made an offer that’s been accepted. Now that you’re under contract, we’ll set up your loan and lock in your rates.

- Reap the rewards – All that’s left to do is enjoy the property and any generated investment occupancy income!

From pre-approval clear to close, we’re here for you.

In Their Own Words

What’s it like working with someone who will always go to bat for you, someone who has closed over $900M in transactions? Hear directly from those who have partnered with Team Parker to scale their real estate portfolio.

Brittany

Parker and her team were very knowledgeable and the level of communication I received was exceptional. The entire process was seamless and I would definitely work with Parker again on my next property!

Michael

Parker and team took ownership of preparing and processing our mortgage. It went smoothly and without any issues. We are grateful for everyone's hardwork and appreciate all levels of communication.

Stephen

The Best I've used Parker 3 times and will continue to call her. She writes back quickly and has the answers. I like to move fast. She can keep up whereas others procrastinate. It's also a plus that she is a texter. Look no further! She is the one!

Eric D

Best lender hands down!! Parker has now closed 6 loans for me (3 primary & 3 investment) and several investment loans for colleagues of mine.. I would never want to use anyone else, even if they offered better terms because of her service and knowledge .. She has been more than “just a lender” to me. She is great at helping with credit, financial strategies, and even tax filing advice! FIVE STARS!!

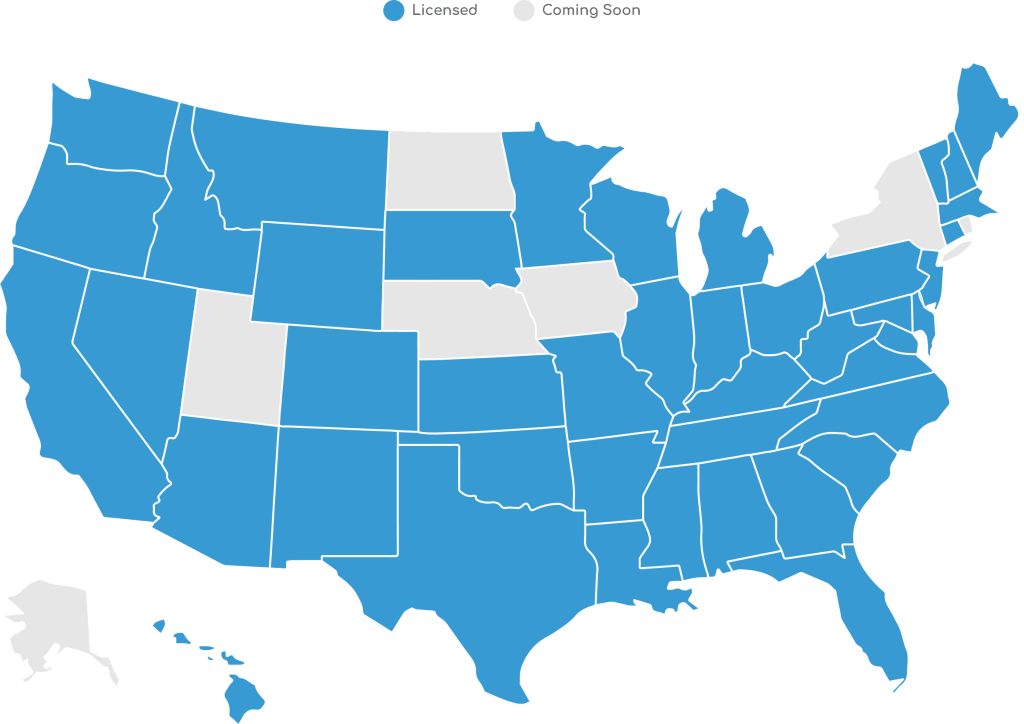

Coast-to-Coast Loan Coverage

We partner with investors and homebuyers all across the country. While based in Tennessee, Wealth Builders Mortgage Group is licensed in 44 states, and because we never give less than 100%, we’re going for all 50.

More Loans to Explore

Not sure if a conventional loan suits your goals? Team Parker offers several other financing options to explore because it’s your wealth; build it your way.