USDA Loans For Primary Home Buyers

Ready to escape the crowds and enjoy your own quiet slice of heaven? A USDA home loan may be for you! Designed to provide affordable options for low- and middle-income earners in rural areas, USDA loans come with many benefits.

Learn about them all, and see if you’re eyeing properties in a USDA-eligible area by teaming up with our lending experts. Get on the path to homeownership by starting an application today!

Explore U.S. Department of Agriculture Loans

Guaranteed by the Rural Development Guarantee Housing Loan Program, which is a part of the U.S. Department of Agriculture, USDA loans may be the perfect way for you to secure property and build wealth. Learn more through a free consultation with Team Parker.

A Fast Path to Funding

In real estate investment, things move quickly, even in rural areas. If you don’t quickly act on a property, you may lose the chance altogether. As homebuyers and investors with portfolios of 10+ short-term rentals, we understand that time is of the essence. Because we’re a group under Movement Mortgage, a national lender, Team Parker:

- Creates our own smooth processes with speedy timelines

- Completes underwriting ourselves

- Funds loans right at closing

Getting you another step closer to financial freedom. We’re one of the top originating teams in the nation for a reason, and we’re here to help you take advantage of every primary home opportunity that comes your way.

Making Property Ownership Accessible to Many

0 Down

Get 100% financing, which means no stressing about coming up with a hefty down payment.

No PMI

Most mortgage loans require private mortgage insurance (PMI) with less than 20% down – not USDA loans.

Competitive Rates

USDA mortgages typically offer lower interest rates than other types because of their low risk to lenders.

USDA Loan Eligibility

Because the government backs USDA loans, there are two sets of eligibility requirements to meet: the government’s and the lender’s. Qualification often comes down to income – as these loans are designed for low- to middle-income buyers – credit score, property size, and debt-to-income ratio.

The property itself also plays a big qualification factor, as it must be located in an eligible rural area. Get a feel for approved areas by exploring the USDA’s interactive map, and contact us to see if you qualify!

The Team Parker Process

- Pre-approval consultation – We’ll discuss your situation, review your debt-to-income ratio, and learn more about where you’d like to purchase property.

- Pre-approval letter – Once approved, we’ll issue your pre-approval letter. Think of this as your ticket to shop the market, as it shows you’re a serious buyer.

- Explore purchase options – This is when you’ll hit the market, exploring eligible properties. Check in with us if any questions arise as you search!

- Lock in – You’ve found a place and made an offer that’s been accepted. Now that you’re under contract, we’ll set up your loan and lock in your rates.

- Reap the rewards – All that’s left to do is enjoy your home!

From pre-approval clear to close, we’re here for you.

In Their Own Words

What’s it like working with someone who will always go to bat for you, someone who has closed over $900M in transactions? Hear directly from those who have partnered with Team Parker to scale their real estate portfolio.

Antonio B

The Best! Parker was specifically recommended to us as being knowledgeable about financing for short-term rental property. We just closed on our second property, with her assistance. There were a number of twists and turns along the way, but Parker was always pleasant, professional, gave good advice, and we always felt that she had our back. She was easy to reach when needed. Because we were looking at property in 4 different states in our region, it helped that she was licensed in all of those states. You know how, when people are good at their job, they make it seem effortless? That is Parker. Just reach out to her, you will be glad you did.

Stephen

The Best I've used Parker 3 times and will continue to call her. She writes back quickly and has the answers. I like to move fast. She can keep up whereas others procrastinate. It's also a plus that she is a texter. Look no further! She is the one!

Brittany

Parker and her team were very knowledgeable and the level of communication I received was exceptional. The entire process was seamless and I would definitely work with Parker again on my next property!

Brandon B

Used 3 times in home buying process. By far the best experience during each home buying experience. We have purchased 3 homes in 4 years since moving to Knoxville and always go back to Parker! Extremely knowledgeable and everything staying on schedule and moves smoothly.

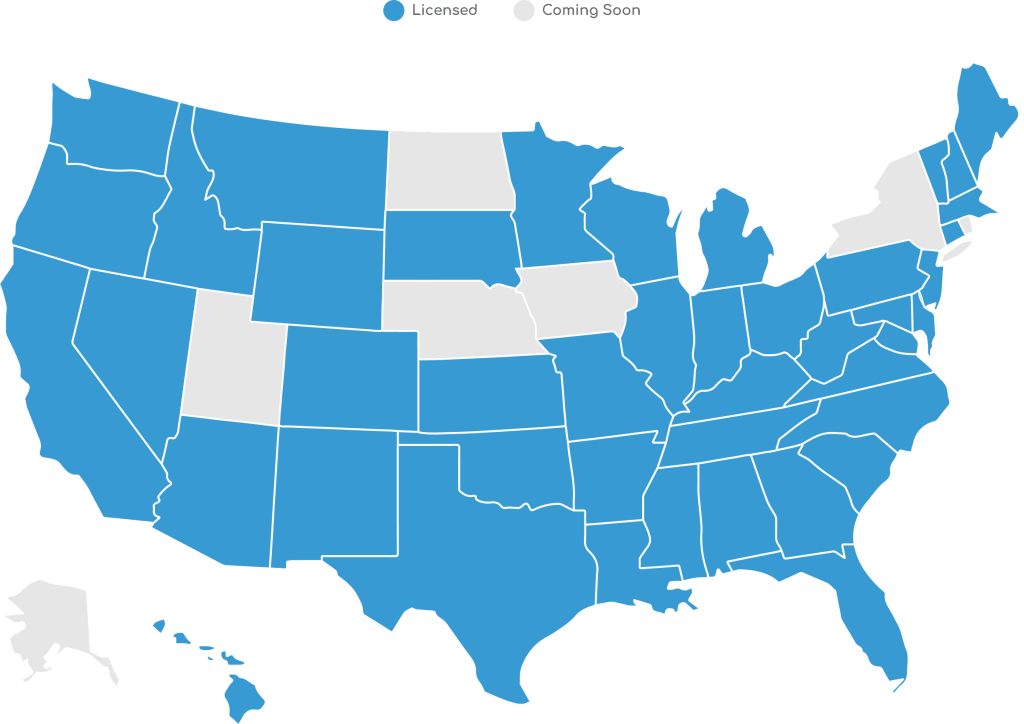

Coast-to-Coast Loan Coverage

We partner with investors and homebuyers all across the country. While based in Tennessee, Wealth Builders Mortgage Group is licensed in 44 states, and because we never give less than 100%, we’re going for all 50.

More Loans to Explore

Not sure if a USDA loan suits your goals? Team Parker offers several other financing options to explore because it’s your wealth; build it your way.