Short-Term Rental (STR) Loans For…

Finance a Second Home

Welcome to second home occupancy, where rest and relaxation meet income generation. As Team Parker has second home occupancies in our own portfolios, we know what it takes – and how – to secure them. Leverage our expertise to expand your real estate portfolio today.

Team up with our Wealth Builders Mortgage Group, even if other lenders have turned you down. We specialize in securing solutions that others can’t because we believe building and diversifying a short-term rental portfolio should be accessible to everyone. Let’s start building and diversifying yours.

Secure an Investment Occupancy Loan

As seasoned investors ourselves, we get it! We understand your goals and the potential of your opportunity. Our team specializes in short-term rental property lending and working with unconventional situations for conventional lending products.

What others call “challenging” we call “exciting.” Our track record of closing loans for clients turned down multiple times before reaching us says it all!

STR Financing for All

Second home occupancy. Short-term rental loan. Vacation home financing. No matter what you call it, Team Parker will help you secure it.

We believe in financial freedom through investing and work with a range of STR investors to help them build generational wealth. Team Parker takes a deep dive into every situation; that’s just one of the many reasons we can close on loans that others can’t. Schedule a time to chat with our investing masters and start building wealth with help from an STR loan.

A Fast Path to Funding

In real estate investment, things move quickly. If you don’t quickly act on a property, you may lose the chance altogether. As investors with portfolios of 10+ short-term rentals, we understand that time is of the essence. Because we’re a group under Movement Mortgage, a national lender, Team Parker:

- Creates our own smooth processes with speedy timelines

- Completes underwriting ourselves

- Funds loans right at closing

Getting you another step closer to financial freedom. We’re one of the top STR originating teams in the nation for a reason, and we’re here to help you take advantage of every second home occupancy opportunity that comes your way.

Why Your Portfolio Needs STRs

Passive Income

Short-term rental properties don’t typically require the oversight that other types of investments demand, making it an easy way to generate passive income.

Diversification

A diverse portfolio is one of the best ways to build long-term wealth and protect yourself from unexpected downturns in other markets.

Tax Incentives

If the home is rented out for the majority of the year, you may qualify for an impressive number of tax breaks, like property tax deductions.

Let’s Chat Eligibility

STR loan eligibility is yet another way we stand apart from other lenders. We don’t list specific requirements because we understand that every buyer and opportunity is different. We are not a one-size-fits-all mortgage lender.

We’ll work with you as the individual you are and get you qualified as-is or set you up for future success. It all starts with a phone call.

Short-Term Rental Loan FAQs

While these are our frequently asked questions, not every answer applies to every buyer. Answers largely depend on your specific situation, and we invite you to schedule a consultation with us to ask these questions or any others you may have.

Do you still do 10% down second home loans?

Yes! Schedule a consultation to discuss your particular situation and learn more.

Do you do DSCR loans?

Of course! Schedule a call with our team or check out ourDSCR loan information to learn more.

What is the minimum down payment for an investment occupancy loan?

Typically, 15% down for an SFH conforming investment occupancy loan. We’d love to discuss specifics and encourage you to schedule time to chat with us.

Do I have to have two years of short-term rental income on my tax returns before it can be counted?

No, not for conforming loans. In fact, we can even use this income with less than one year of reporting as long as the tax return has been filed.

Do I have to have two years of self-employment on my taxes in order for it to count?

Not always – in many cases, we can use one year of your self-employment income. Contact Team Parker to learn more.

If I just started a new W2 job, can the income be counted?

Absolutely. Any regular income that is not variable from your new job can be counted.

I just graduated college and started working. Do I have to wait two years before my income can be counted?

Nope, we can typically count full-time hourly and salary income immediately. Some stipulations may apply, but we’ll review those with you as we discuss your options.

Will bonus depreciation/cost segregation expenses hurt my rental income on my tax returns?

No – we can add all of that back into the income equation. Have at it!

How long does it take to close on a property?

30 days is comfortable and ensures a smooth, enjoyable process. We can close in less than 30 days if necessary – we’ve even closed in one week for clients who had financing through another lender fall through – but that quick turnaround can be more stressful for you, as you’ll need to complete all paperwork in a short amount of time.

Won't buying a property in my name hurt my debt-to-income ratio?

Only until you get your tax returns files showing that income; then the income can be counted and should ideally offset that mortgage payment and provide additional income to help your DTI.

What is the max debt-to-income ratio?

Debt-to-income (DTI) ratios are mostly determined by running your loan through the Fannie/Freddie software. Typically, it allows up to 50% DTI, but occasionally may not allow higher than 45%, sometimes even lower. This is usually the case for those with riskier profiles combined with lower credit scores.

The Team Parker Process

- Pre-approval consultation – We’ll discuss your goals, review your debt-to-income ratio, and learn about your cash-to-close reserves before examining your multi-unit loan options.

- Pre-approval letter – Once approved, we’ll issue your pre-approval letter. Think of this as your ticket to shop the market, as it shows you’re a serious buyer.

- Explore purchase options – This is when you’ll hit the market, exploring available properties. Check in with us if any questions arise as you search!

- Lock in – You’ve found a place and made an offer that’s been accepted. Now that you’re under contract, we’ll set up your loan and lock in your rates.

- Reap the rewards – All that’s left to do is enjoy the property and any generated investment occupancy income!

From pre-approval clear to close, we’re here for you.

In Their Own Words

What’s it like working with someone who will always go to bat for you, someone who has closed over $900M in transactions? Hear directly from those who have partnered with Team Parker to scale their real estate portfolio.

Brad

Super helpful! Parker is super responsive and is more advisor than lender for our business. She’s does the short term rental business herself, so can relate first hand to what we do. She has a wide variety of loan products available, so it’s easy for her to find something that works. Her rates are competitive with other lenders (even direct to the bank). Highly recommended.

Avery C

I'll never use anyone else! Parker was recommended to me by a real estate agent friend for an investment property I was working on purchasing back in December of 2016. Since then I have used her for every real estate purchase I have made and never looked back, and I also refer all of my clients and friends to her. She is incredibly knowledgeable, and quick in getting things done, and you never have to call her twice to get a question answered. I highly recommend Parker to both new and seasoned homebuyers. She makes the process smooth and easy!

Michelle

Parker is fantastic. 2nd time working with her and it won't be the last Parker worked with us on 2 short term rentals in the Smokies. Both experiences went very smoothly and easily closed within 30 days. Parker owns short term rentals herself so she is an expert with these types of loans. I couldn't have bought the 2nd rental if I wasn't working with Parker. A++ Loan officer!

Lenny B

Great loan officer/very easy process. Parker was a great delight to work with. She walked my wife and myself easily through the process of financing our first home. She worked very hard to get us the best interest rates and the best type of loan for our situation. She was very reachable also for any questions we might have had. We highly recommend her!

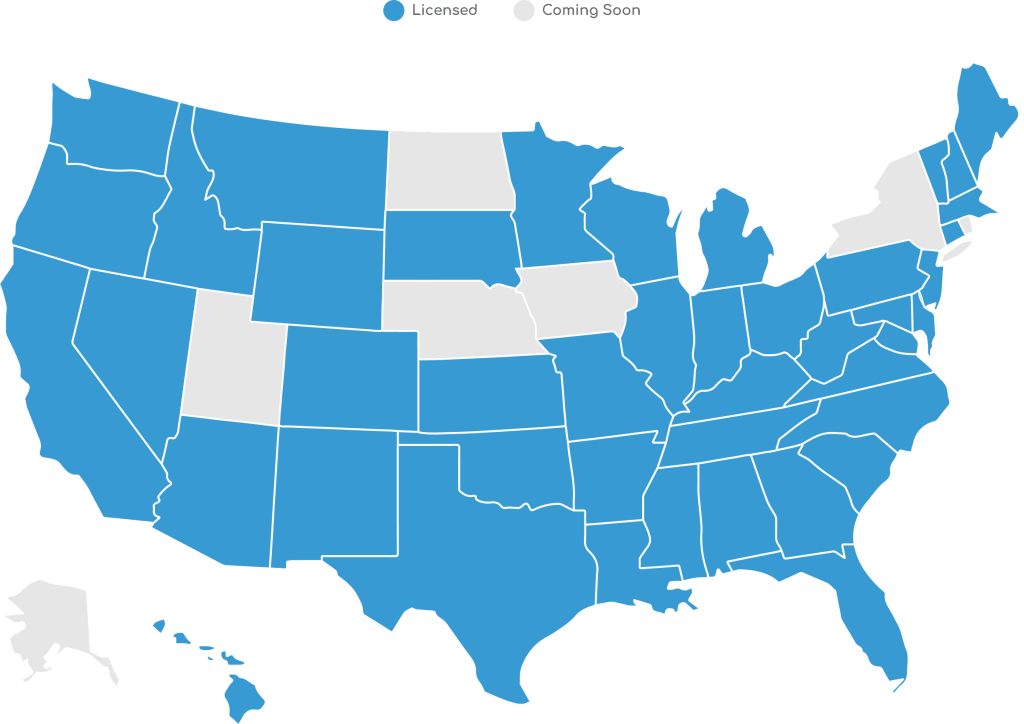

Coast-to-Coast Loan Coverage

We partner with investors and homebuyers all across the country. While based in Tennessee, Wealth Builders Mortgage Group is licensed in 44 states, and because we never give less than 100%, we’re going for all 50.

More Loans to Explore

Not sure if a short-term rental loan suits your goals? Team Parker offers several other financing options to explore because it’s your wealth; build it your way.