Jumbo Loans For…

Add a Second Home to Your Portfolio

Build your real estate portfolio with the help of a jumbo loan! Because it’s a specialty lending product, it’s imperative to work with experienced professionals who are well-versed in jumbo loans, like Team Parker.

From guidance to originating to underwriting, our group of mortgage lenders has the expertise you’re looking for – expertise that will help you start or scale your real estate portfolio.

Secure an Investment Property

Jumbo loans are as unique as your investment opportunity – no two are the same. Get assistance navigating these specialty lending products from investors who have STR and LTR properties of their own – turn to Team Parker.

We understand the complexities of jumbo loans and know how to originate and underwrite these transactions. Reach out for a seamless lending experience and expert guidance from investors ready to help you succeed.

Buy Your Primary Home

Find and secure your perfect property with help from a jumbo loan and our Wealth Builders Mortgage Group. As investors turned lenders, Team Parker understands the unique complexities of this specialty product.

We’ll not only review the jumbo home loans that set you up for success; we’ll answer your questions, provide guidance, share insights gleaned from years of investing experience, and help you build generational wealth. And it all starts with an application.

Your Jumbo Loan Guru

Navigate jumbo loan options like a pro – team up with Wealth Builders Mortgage Group, also known as Team Parker. We offer the guidance, support, originating, and underwriting you need to secure your property. Skip the lending stress by getting in touch with us today.

A Fast Path to Funding

In real estate investment, things move quickly. If you don’t quickly act on a property, you may lose the chance altogether. As homebuyers and investors with portfolios of 10+ short-term rentals, we understand that time is of the essence. Because we’re a group under Movement Mortgage, a national lender, Team Parker:

- Creates our own smooth processes with speedy timelines

- Completes underwriting ourselves

- Funds loans right at closing

We get you another step closer to financial freedom. We’re one of the top originating teams in the nation for a reason, and we’re here to help you take advantage of every investment, second home occupancy, and primary home opportunity that comes your way.

Big Loans, Big Benefits

More Opportunity

With more funding comes more opportunity. Investors with jumbo loans may be able to secure larger properties or ones in more expensive markets.

Competitive Down Payments

10% and even 5% down payment amounts are available, making them even more accessible to a variety of investors and first-time home buyers.

Flexible Terms

Because jumbo loans aren’t restricted by Fannie Mae or Freddie Mac, lenders have more leeway and are often able to create terms specific to the borrower.

Eligibility

If there’s one thing jumbo loans have in common, it’s that they’re unique. Being complex lending products rife with caveats and exceptions, it’s best to work with experienced jumbo loan professionals who can guide you through eligibility, like Team Parker! Book a consultation to discuss your needs and review your jumbo loan eligibility.

Jumbo Loan FAQs

Do you have a 10% down second home loan?

Yes! Schedule a complimentary consultation to learn more and discuss your eligibility.

What is the typical down payment?

The typical down payment amount for a jumbo loan is 20%. That doesn’t mean there are no other options! As a specialty lending product that isn’t tied to Fannie Mae or Freddie Mac, we have more flexibility when it comes to jumbo loans. Get in touch with Team Parker to learn more!

What is the max debt-to-income (DTI) ratio for jumbo loans?

The typical max DTI ratio is 43%. However, we have a couple of programs that allow up to 45% and even up to 50%. Contact us when you’re ready to chat about your lending options.

Does it take a longer time to close a jumbo loan?

Not necessarily. The guidelines are usually more intricate, but because we’re well-versed in jumbo loans, Team Parker can still comfortably close on these in 30 days.

Aren't the interest rates higher on jumbo loans?

Not as a hard rule! As with any loan, interest rates fluctuate, and they don’t always change on the same scale that conforming loans do. That being said, jumbo loans are usually comparable to conforming loan rates; sometimes, they can even be better!

It’s important to remember that every jumbo program has its own pricing, with the more risky products priced accordingly.

The Team Parker Process

- Pre-approval consultation – We’ll discuss your goals, review your debt-to-income ratio, and learn about your cash-to-close reserves before examining your multi-unit loan options.

- Pre-approval letter – Once approved, we’ll issue your pre-approval letter. Think of this as your ticket to shop the market, as it shows you’re a serious buyer.

- Explore purchase options – This is when you’ll hit the market, exploring available properties. Check in with us if any questions arise as you search!

- Lock in – You’ve found a place and made an offer that’s been accepted. Now that you’re under contract, we’ll set up your loan and lock in your rates.

- Reap the rewards – All that’s left to do is enjoy the property and any generated investment occupancy income!

From pre-approval clear to close, we’re here for you.

In Their Own Words

What’s it like working with someone who will always go to bat for you, someone who has closed over $900M in transactions? Hear directly from those who have partnered with Team Parker to scale their real estate portfolio.

Michael

Parker and team took ownership of preparing and processing our mortgage. It went smoothly and without any issues. We are grateful for everyone's hardwork and appreciate all levels of communication.

Mitch

Parker’s team worked communicated well and worked very efficiently for a quick closing!

Russell G

Parker was very responsive and helpful throughout the whole process.

Stephen

The Best I've used Parker 3 times and will continue to call her. She writes back quickly and has the answers. I like to move fast. She can keep up whereas others procrastinate. It's also a plus that she is a texter. Look no further! She is the one!

Coast-to-Coast Loan Coverage

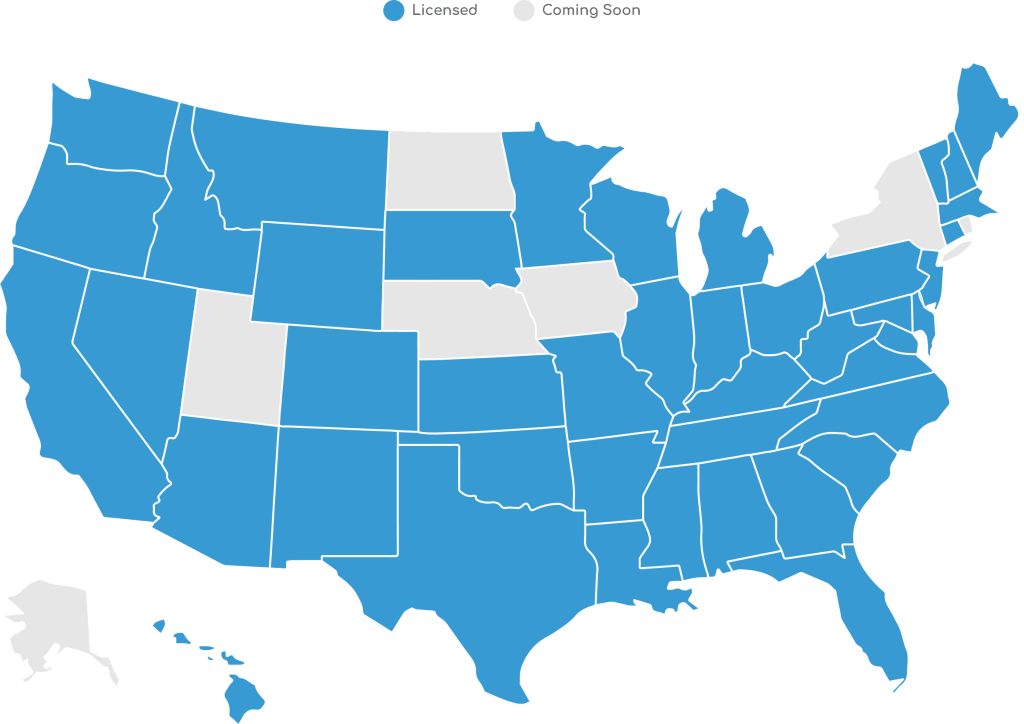

We partner with investors and homebuyers all across the country. While based in Tennessee, Wealth Builders Mortgage Group is licensed in 44 states, and because we never give less than 100%, we’re going for all 50.

More Loans to Explore

Not sure if a jumbo loan suits your goals? Team Parker offers several other financing options to explore because it’s your wealth; build it your way.