FHA Loans For…

Explore Second Home Financing

What will many FHA loan lenders tell you? It’s not possible to finance a second home with this type of loan. What will our lending experts tell you? There’s a solution for every situation.

You may be able to secure your second home occupancy through an FHA loan, as there are many exceptions to the primary home rule. Apply for an FHA loan to get started. Our mortgage masters will review your information and goals so that we can present lending solutions that set you up for success.

Invest With an FHA Loan? It’s possible!

Good investors explore every lending avenue to determine which offers the best benefits for their unique situation. Great investors team up with experts who already know the ins and outs of every lending option.

Get on the path to investor greatness by turning to Team Parker today. It may be possible to secure a property for investment occupancy with an FHA loan, and if you qualify, we’ll show you how. Start an application to get your information into our hands. We’ll be in touch with solutions soon!

Secure a Home With an FHA Loan

How does buying your very first home with only 3.5% down sound? Too good to be true? Not with Team Parker by your side!

Don’t let limited savings or a below-average credit score stop you from owning a place of your own – explore your FHA home loan options with help from our pros. Securing the flexible financing you need with the competitive terms you deserve all starts with an application.

Making Homeownership Accessible to All

Insured by the Federal Housing Administration (FHA), these loans are great options for those with limited savings or less-than-perfect credit scores. It may even be possible to use an FHA loan to secure a second home or investment occupancy property. Schedule a complimentary consultation to learn more!

A Fast Path to Funding

In real estate investment, things move quickly. If you don’t act fast on a property, you may lose the chance altogether. As homebuyers and investors with portfolios of 10+ short-term rentals, we understand that time is of the essence. Because we’re a group under Movement Mortgage, a national lender, Team Parker:

- Creates our own smooth processes with speedy timelines

- Completes underwriting ourselves

- Funds loans right at closing

Getting you another step closer to financial freedom with help from an FHA loan. We’re one of the top originating teams in the nation for a reason, and we’re here to help you take advantage of every investment, second home occupancy, and primary home opportunity that comes your way.

Federal Housing Administration Loan Perks

Less Strict

An FHA loan is one of the easiest to qualify for. They’re especially great for buyers with less-than-perfect credit.

Affordable Down Payments

If you have a credit score of 580 or higher, you may be eligible for a down payment of only 3.5%!

Property Options

FHA loans aren’t only for single-unit properties. Eligible borrowers can finance a four-unit purchase.

Determine Your Eligibility

If you’re wondering if an FHA loan is the best financing option for your situation, let Wealth Builders Mortgage Group assist. Qualification depends on the type of property you’re interested in buying and your unique financial situation, so it’s best to speak with a lending expert before making any moves.

Book a complimentary call with Team Parker to discuss your FHA loan eligibility and options – if there’s a lending solution better suited to your goals, we’ll let you know!

The Team Parker Process

- Pre-approval consultation – We’ll discuss your goals, review your debt-to-income ratio, and learn about your cash-to-close reserves before examining your multi-unit loan options.

- Pre-approval letter – Once approved, we’ll issue your pre-approval letter. Think of this as your ticket to shop the market, as it shows you’re a serious buyer.

- Explore purchase options – This is when you’ll hit the market, exploring available properties. Check in with us if any questions arise as you search!

- Lock in – You’ve found a place and made an offer that’s been accepted. Now that you’re under contract, we’ll set up your loan and lock in your rates.

- Reap the rewards – All that’s left to do is enjoy the property and any generated investment occupancy income!

From pre-approval clear to close, we’re here for you.

In Their Own Words

What’s it like working with someone who will always go to bat for you, someone who has closed over $900M in transactions? Hear directly from those who have partnered with Team Parker to scale their real estate portfolio.

Antonio B

The Best! Parker was specifically recommended to us as being knowledgeable about financing for short-term rental property. We just closed on our second property, with her assistance. There were a number of twists and turns along the way, but Parker was always pleasant, professional, gave good advice, and we always felt that she had our back. She was easy to reach when needed. Because we were looking at property in 4 different states in our region, it helped that she was licensed in all of those states. You know how, when people are good at their job, they make it seem effortless? That is Parker. Just reach out to her, you will be glad you did.

Eric D

Best lender hands down!! Parker has now closed 6 loans for me (3 primary & 3 investment) and several investment loans for colleagues of mine.. I would never want to use anyone else, even if they offered better terms because of her service and knowledge .. She has been more than “just a lender” to me. She is great at helping with credit, financial strategies, and even tax filing advice! FIVE STARS!!

Russell G

Parker was very responsive and helpful throughout the whole process.

Mitch

Parker’s team worked communicated well and worked very efficiently for a quick closing!

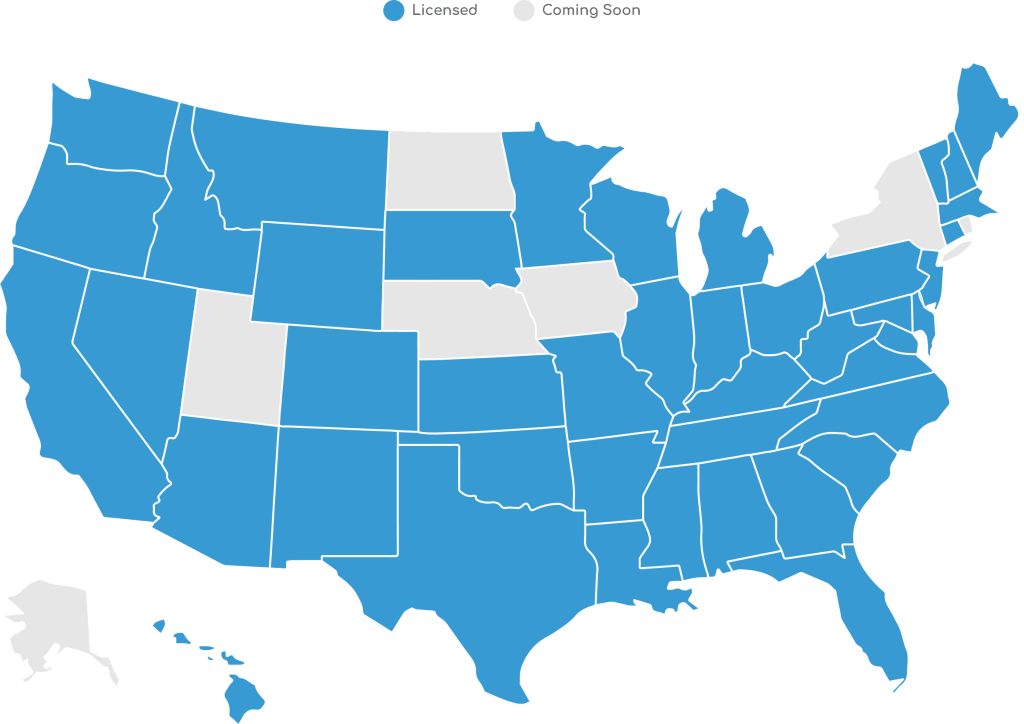

Coast-to-Coast Loan Coverage

We partner with investors and homebuyers all across the country. While based in Tennessee, Wealth Builders Mortgage Group is licensed in 44 states, and because we never give less than 100%, we’re going for all 50.

More Loans to Explore

Not sure if a Federal Housing Administration loan suits your goals? Team Parker offers several other financing options to explore because it’s your wealth; build it your way.